The Plunge Protection Team – Trust Your Government They Have Your Back

When it comes to investing in the stock market, no one wants to risk a major crash. Nearly three decades ago, stock markets around the world experienced a dramatic one-day drop—the 1987 crash. This exacerbated global economic worries and lead to the creation of an important safety net for investors: The Plunge Protection Team (PPT). But what does the PPT do? Why was it created? And more importantly, how is this vital government team still protecting us from disastrous financial situations today? In this post, we’ll explore how PPT works and how it represents definitive proof that there is no such thing as a “free market”.

Overview of the Plunge Protection Team (PPT) and its purpose

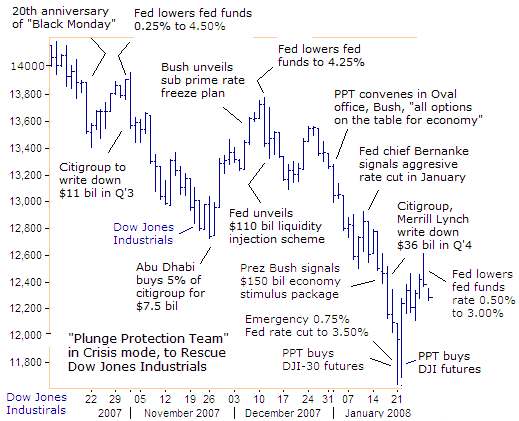

Established after the stock market crash of 1987, the Plunge Protection Team (PPT) is a specially appointed group from the federal government focused on averting future crashes in markets. The primary mechanism of this team is the Federal Reserve Trading Desk whose purpose is to “support equity prices” if needed and prevent drastic drops that could impact investor confidence. Let’s think critically about what that really means to “support equity prices”. You guessed it, the PPT is buying stocks in order to prevent “plunges” in the stock market.

The way the PPT is described includes research and advice from reputable financial & economic experts that allows for addressing weaknesses in the stable functioning of American markets. As such, the PPT works to protect investors and ensure capital market stability by operating both proactively and reactively to issues that may arise in the financial system.

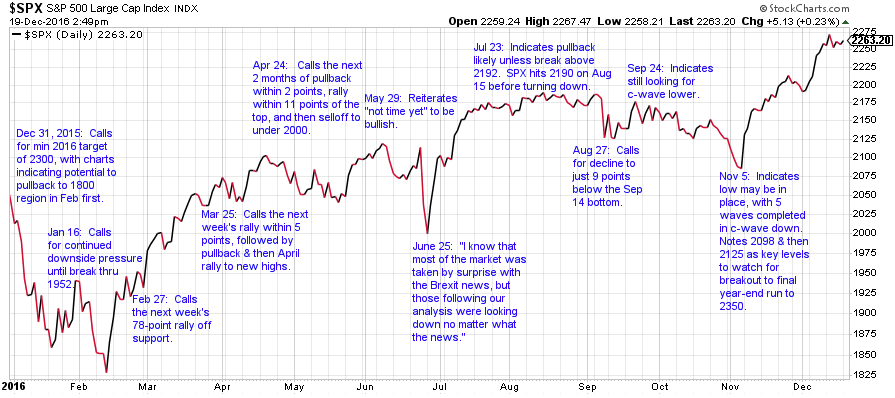

It sure sounds like the PPT can help create larger and larger bubbles in markets during times of monetary expansion. While they call it monetary expansion, let’s be real here it is actually “currency expansion” which is also described as quantitative easing.

Why the PPT was created in the wake of the 1987 crash

Following the economic crisis and significant stock market crash of 1987, the Plunge Protection Team (PPT) was created to ensure stability in equities trading and protect against financial disaster. Centered around the Federal Reserve’s Trading Desk, this inter-agency group of government officials and so called financial experts works together to uphold confidence in stock markets by intervening with trading whenever necessary. Over 30 years later, the PPT still combats major shifts and dips in stock values to prevent another devastating market crash.

Ever wonder why lately after we have a day where the market drops considerably, the next day it’s back up? Now you know many of those cycles are created when the PPT through the Federal Reserve Trading Desk is buying up the market in a dip.

How the PPT works to prevent stock market crashes

The PPT uses a variety of strategies such as engaging with banks and brokers to buy large amounts of stocks, attempt to identify risky securities, provide liquidity for stock trades, and coordinate efforts between public-private organizations. It is these relentless efforts from the PPT that have proven effective in keeping market stability over three decades since its implementation but at what cost is this “always up” equity market when we have so many other bubbles being created through “monetary expansion”? Also, this PPT sure didn’t help so much for the dot-com bust or the 2008 crash!

The political aspects of the PPT’s actions

The Plunge Protection Team (PPT) is a governmental intervention into the free market and has sparked debate regarding its role in politics. Arguments arise as to how much money (currency) and control over the stock market should be in the hands of government officials. Some have argued that avoiding potential disasters, such as the government bailouts of “too big to fail” banks during the financial crisis of 2008, shows the benefits of intervention and that it should continue. But should our government really be colluding with negligent banks and potentially making them more dangerous and definitively more powerful? Does this manipulation of markets simply interfere with the free market and and just bring us closer to an entire banking system in default? PPT is clearly a hot political topic and one to articulate in terms of understanding that we do not now and arguably have never had a truly “free market”. Where it goes from here we will all be seeing…

The effectiveness of the PPT in preventing recessions and collapses

Since the Plunge Protection Team was created in 1989 (in response to the 1987 market crash) and some argue that it was used successfully during the dot-com bust but is it really a means of preventing an economic recession? The 2008 financial crisis raised questions about the effectiveness of its policies. Interest rates were lowered to historic lows, yet unrealized losses through bank insolvency and deflationary yield curves far exceeded previous estimates. To date, economists are still debating whether or not policies adopted by the PPT before, during and after 2008 helped to mitigate the fallout from this recession. Some of us also argue that all of the fed policies since 2008 have created the biggest bubbles our financial markets have ever seen among multiple different asset classes and that when these all burst it is likely to be a systemic catastrophe our world has never seen before, far worse than even the great depression.

Potential risks associated with relying on the PPT

Despite the Plunge Protection Team’s good intentions, there are certain potential risks associated with relying on them. If bail out and other cash infusions become commonplace, they could lead to an over-inflated sense of security which, in turn, could result in an increased risk of bank insolvency due to unrealized losses that were deferred by the PPT’s monetary intervention. Additionally, the team’s ability to create artificial market stability along with the manipulation of interest rates increasing or decreasing too fast can actually further destabilize banks such as what we have seen lately with the failure of SVB (Silicon Valley Bank) and Signature Bank among others. Are these interventions actual progress or simply market manipulation?

In conclusion, while the intention of the Plunge Protection Team may have originally been put in place to protect the stock market from large-scale crashes, it’s value today is rationally being questioned. It was created in 1989 in response to the 1987 crash to prevent other crashes but we’ve experienced a few crashes since that time. Many investors don’t even know this PPT exists and also don’t know about the Federal Reserve Trading Desk and still think we have a true “free market”. The pundits of the PPT argue that it’s produced positive results, avoiding recessions and even collapsing markets but as I’ve mentioned we’ve still had a number of these events and to argue that our markets are healthy right now seems pretty ridiculous.

Moving into this tumultuous time in the cycle of the markets you must consider all factors when investing and look for ways to diversify your investments long-term. As an alternative to a highly manipulated equity market, a Gold IRA can not only help you diversify your portfolio but shield you from unexpected market volatility with some potential tax advantages to boot! Click here to get your free Precious Metals IRA kit and get in touch with our preferred partner who can set it up for you or rollover an existing IRA into a self-directed IRA for precious metals holdings.

Affiliate Disclaimer:

We review products independently with as much accuracy as possible, but we may earn affiliate commissions if you click a link and purchase a product.

Here’s some recent financial related videos from our bitchute channel:

David Morgan (the Silver Guru) warns Mike Adams about FRACTURING of the conventional banking system

Gerald Celente on the Death of the Dollar and What to Expect in the Fallout Clip1

Edward Dowd Existenstial Question – Is The Collapse Of The US Dollar Inevitable

Peymon Mottahedeh – A Banana Republic Has Been BORN as US Taxpayers Finance Government That HATES U

You can see all these videos right when we post them and subscribe on our bitchute channel here:

https://www.bitchute.com/channel/knowingthetruth

Independent precious metals investor since 2006 who has learned through mistakes he hopes to help you avoid. Self employed entrepreneur since birth 😉 Owner of www.HealthHarmonic.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/tny_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/tny_ag_en_usoz_2.gif)