Will the BRICS System Replace the Eurodollar For International Transactions

The phenomena known as the “Eurodollar” is often referred to as the “Petrodollar”. In recent years, the BRICS system has emerged as a rival to the traditional dominance of the Eurodollar in the settlement of international transactions. As investors become increasingly aware of this new model, it begs one crucial question: is the BRICS system capable of replacing the Eurodollar?

This blog will explore this topic from an analytical and informative point-of-view with an overview of what the Eurodollar is and it’s history as well as how the relatively newer BRICS system is evolving and what potential it may hold.

Introducing the Eurodollar and its role in international transactions

In the world of international finance, the Eurodollar plays a crucial role in facilitating transactions between countries. Despite its name, the Eurodollar is not a currency created by the European Union but rather denotes U.S. dollars held in banks outside the United States as well as the fractional reserve creation of such dollars.

This has made the Eurodollar market one of the largest and most important in the world, with billions of dollars traded every day. Keep in mind this is all outside of the territory of the US Federal Reserve but instead conducted among European banks. With its accessibility and ease of use, the Eurodollar has become a popular choice for multinational corporations and international banks alike. As global trade and commerce continue to expand, the importance of the Eurodollar will only continue to grow. Its role as a crucial currency in international transactions underscores the interconnectedness of the modern global economy.

With all that being said, one important point to consider is the Eurodollar is a system of currency and not of “money”. I make that distinction because the Eurodollar is used as a means of exchange (currency) and due to the fractional reserve system and continual dilution (debasing) of this currency it has been slowly losing it’s ability to store value which is what I consider an important part of the definition of money in contrast to “currency” which may not store wealth.

Examining the Origins of the BRICS System and its Role in International Transactions

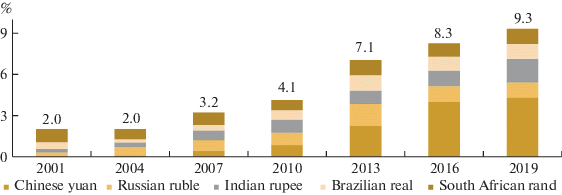

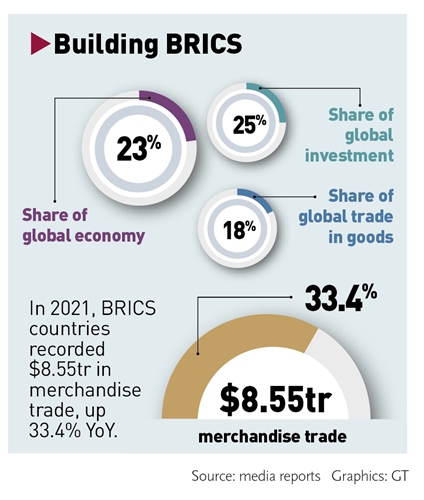

The BRICS system is an acronym for Brazil, Russia, India, China, and South Africa, five nations that are emerging as global economic powerhouses. Examining the origins of the BRICS system reveals a fascinating history; the initial concept was coined by then-chairman of Goldman Sachs Asset Management, Jim O’Neill, in 2001. Since the inception of the grouping in 2009, BRICS has evolved into a formidable force that promotes cooperation, sustainable development, and innovation. The role of the BRICS system is not to be taken lightly, as it has already shown its potential to influence international transactions. As a serious topic of interest, understanding the origins of the BRICS system and its evolution is crucial for anyone invested in the global economy.

Can BRICS Overtake the Eurodollar As The World Reserve Currency?

The Eurodollar system has long been the dominant force in international financial transactions and trade. However, recent developments in the global economy have brought attention to the rise of the BRICS system. The BRICS nations are renowned for their fast-growing economies and immense potential for technological advances. As a result, there has been speculation about whether the rise of the BRICS system will end the supremacy of the Eurodollar System.

It is worth noting that the petrodollar has played a significant role in the current global economic landscape, as it is the basis of the world’s Eurodollar financial system. In recent times it has also been used as a geopolitical weapon through the imposition of trade sanctions. To this end, the BRICS countries’ effort to become more financially independent and reduce their reliance on the US dollar, and thus the Eurodollar, as a means of trade and settlement could lead to the demise of the Eurodollar System. However, it remains to be seen whether the BRICS countries have the power and infrastructure to assert themselves as a new financial superpower on the global stage.

One thing to be sure is that the BRICS countries are amassing huge amounts of gold into their central banks and their goal seems to be driven as a commodity (largely gold) backed system for trade in order to be able to transact outside of the Eurodollar system. Whether that results in a new global reserve currency however is yet to be seen and would likely take a considerable amount of time to be implemented.

Will The Petrodollar Be Suddenly Replaced by BRICS Next Week?

The Eurodollar fractional reserve system is a complex yet integral part of the international banking system. This system allows banks to create US dollars outside of the US, which in turn promotes dominance in the world of settlement of international transactions. The phenomenon of the “petrodollar” is often used to describe the dominance of the US dollar in the oil trade, but it’s actually more accurately defined as the Eurodollar due to the vast amount of US dollars being held in foreign banks outside of the US.

Another factor that holds the power of the Eurodollar system is the fact that so many countries hold so much US dollar debt in the form of US Treasury bills, notes and bonds. Could there be a default on these at some point in the future? Sure this is possible but the fact is that currently many other countries are in even worse shape than the US. Will it all come crashing down and there be a global default on the entire financial system? Again, it’s possible but a softer crash may be what the world’s central banks would prefer in any case.

No one can predict the future in it’s entirety but understanding this intricate system and its implications is crucial if you are interested in protecting your investments and being prepared for the future.

Will BRICS Dominate International Trade? If Not Next Week Then When?

The global financial system has been undergoing a significant transformation in the recent years, particularly with regards to the monetary systems that govern international trade. Fiat monetary systems are increasingly becoming less efficient due to the expansion of the Eurodollar. The Eurodollar has grown exponentially over the past few decades, leading to an oversupply of dollars in the global economy. This oversupply of dollars leads to a reduction in the purchasing power of individual dollars and can ultimately threaten the stability of the world monetary system. As such, there has been a growing push towards a commodity-backed BRICS dominated settlement system for international trade. This new system has the potential to provide stability to the global financial system, reduce the risk of currency wars, and promote a greater level of economic development among developing countries. Will this be a parallel system or stand to at some point replace the Eurodollar system of international trade? The potential benefits of a commodity backed system for international trade have spurred on many new countries to apply to join BRICS including Turkey and Saudi Arabia.

Of course the big question that really can’t be answered in advance is if and when this new system may replace the Eurodollar system as well as in what capacity? Will it replace only in oil trade or the trade of other goods as well? Also will BRICS even be what we’ve known as a currency or simply used to settle international trade?

What Would The Transition From Eurodollar to a BRICS or CBDC Look Like?

The transition from the Eurodollar system into a commodity backed BRICS system is not going to be a smooth ride. It will be a deeply complex and challenging operation, raising a plethora of political, economic, and geopolitical dilemmas for every nation involved. The IMF, as the traditional arbiter of the international financial system, would need to accommodate the shifting tides, while the partner countries should ensure that their domestic policies converge to navigate the paradigm shift. There are also no guarantees that it would prove to be a better option than the Eurodollar system, which is the bedrock of the global economy.

That being said the rise of authoritarian and technocratic control is pushing for CBDCs or Central Bank Digital Currencies due to their ability to control populations. These CBDCs may end-up getting more exposure, but the actual BRICS currency might remain a distant reality. Anybody anticipating the time frame of this disruption could be in for a rude shock, as this is no ordinary shift, judging from the scale of transformation it would bring to the global financial institutions.

Anyone anticipating changes like these may be smart to do like the central banks are doing and consider Gold and Silver investments as a hedge against the inherent risk that is embedded in the system right now. It’s also important to do your own due diligence to make sure precious metals are right for you – but when you do and you are ready please check out our sponsor here who will provide you with a free Gold IRA kit and can help setup a new Gold IRA or help you rollover your existing IRA or 401k into a self directed Precious Metals IRA so you can be positioned for the changes that seem to be ripe to happen sometime soon in this tumultuous financial system.

Affiliate Disclaimer: We review products independently with as much accuracy as possible, but we may earn affiliate commissions if you click a link and purchase a product.

Here’s some recent financial related videos from our bitchute channel:

How The Banks Work And Why They Are Collapsing

Central Banks Main Job is to Inflate the Economy to Integrate Currency Control

HOLLYWOOD’S Marxist Programming – Nerd War on Woke

You can see all these videos right when we post them and subscribe on our bitchute channel here:

https://www.bitchute.com/channel/knowingthetruth

Independent precious metals investor since 2006 who has learned through mistakes he hopes to help you avoid. Self employed entrepreneur since birth 😉 Owner of www.HealthHarmonic.com