Should You Care About The Gold to Silver Ratio In Precious Metals Investing?

Does the Gold to Silver Ratio matter for precious metals investing? Is this a metric that may be helpful to determine whether gold or silver is a better investment right now? These concepts will be explored in great detail in this post.

The gold-to-silver ratio (GSR) is actually one of the most important metrics that precious metal investors should pay attention to. By understanding the historical patterns and factors affecting this ratio, investors may enhance their portfolio’s potential return and more.

In this blog post, we’ll go into further detail about exactly what the GSR is, provide insights from a historical analysis on trends and patterns in its movements, and discuss why taking note of fluctuations of this often overlooked but crucial ratio could prove beneficial for all aspiring metals investors.

What is the Gold-to-Silver Ratio and How Does it Work

:max_bytes(150000):strip_icc()/GettyImages-174072047-4ca848d55c1a4c26a799fa60ad80b32e.jpg)

The gold-to-silver ratio is a metric used by investors to measure the relative value between gold and silver. It is calculated by dividing the current price of one ounce of gold by the current price of one ounce of silver.

For centuries, experienced investors and traders have been using the GSR to get an insight on whether one metal is undervalued or overvalued compared to the other. It has also been used as an indicator to predict potential trends in prices, allowing investors to determine the optimal time to buy or sell gold or silver.

With careful analysis of the GSR’s historical data, investors can assess how various factors such as inflation, currency movements, and geopolitical events influence this metric over time. All in all, understanding the gold-to-silver ratio is essential in making informed decisions regarding investments in these sectors.

Historical Analysis of the Gold-to-Silver Ratio: Identifying Trends and Patterns

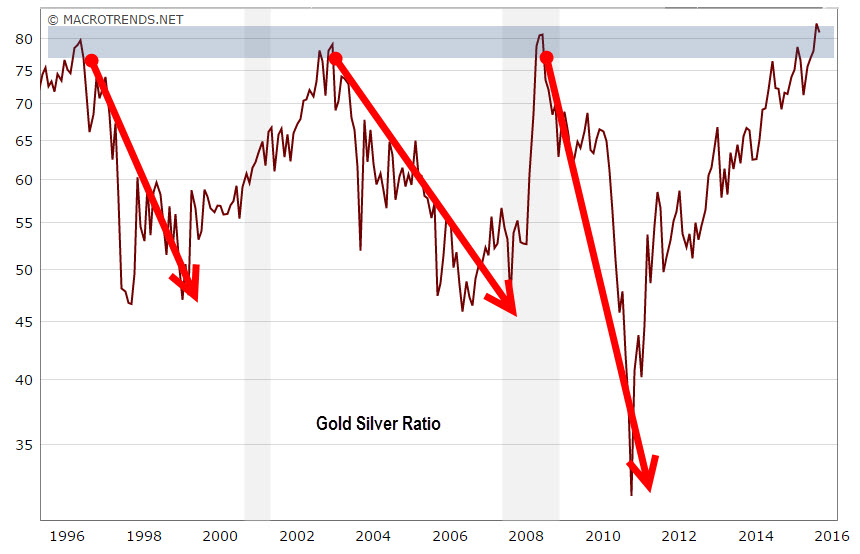

One key insight on the GSR is that it follows a cyclical pattern, where it regularly rises to an upper peak and falls back to a lower trough before returning to its peak again. The ratio’s peaks often give us clues as to how the market will respond, while its valleys indicate times when buyers might find better deals on silver compared to gold.

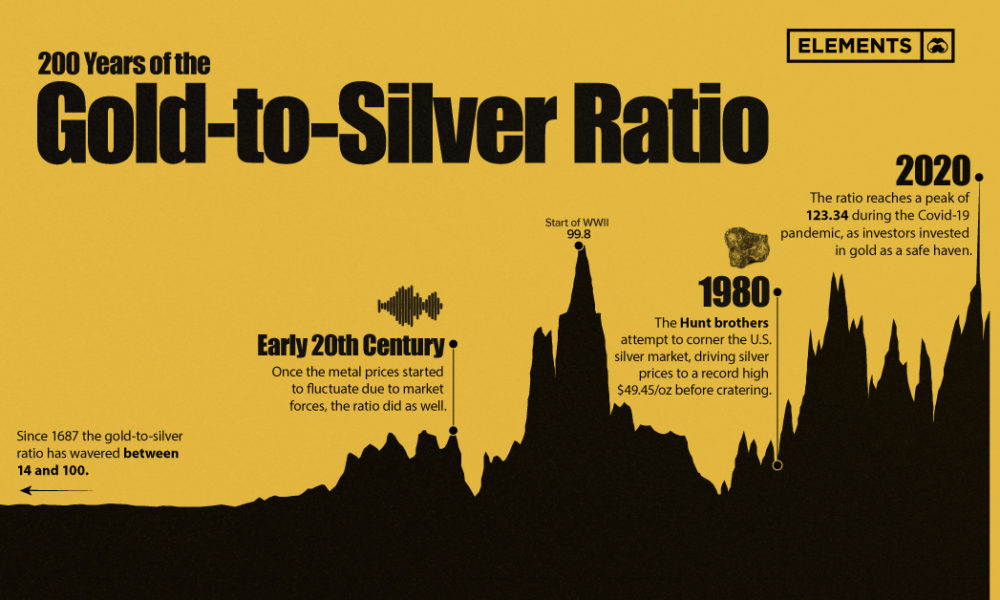

For a long time, the ratio has averaged around 47-50. But this average fluctuated over time. It started as low as 15:1 in 1792 when the First Coinage Act was passed, making the US Dollar our official currency. It rose to almost 100 in 1939 when Roosevelt confiscated and revalued gold from $20.67 to $35. It then hit a low of 16 in the 1970s when the Hunt Brothers (American oil company executives) started buying large amounts of silver because of the restrictions on gold ownership and in an alleged attempt to manipulate the price of silver long before the manipulation of these markets became standard practice with ETFs!

What followed was the ratio rose steadily as gold outperformed silver. But it was not until the 2008 Financial Crisis that the ratio hit 80 and peaked at more than 125 in 2020. As of the past year, the gold-to-silver ratio is ranging between 75 to 95.

As you may have noticed, the gold-to-silver ratio is constantly fluctuating due to multiple factors. But understanding this metric and the factors that affect it can help investors forecast future market movements, giving you a competitive edge in the precious metals market because you’ll know the inside scoop.

Understanding the Factors Affecting the Gold-to-Silver Ratio

:max_bytes(150000):strip_icc()/what-drives-the-price-of-gold.aspx_final-ba9f1dae6cd34de18e6021738f196de5.png)

One of the most important factors affecting the GSR is the supply and demand dynamics of each metal. Gold is typically viewed as a safe-haven asset and a store of value, which means that demand for gold often increases during times of economic uncertainty or geopolitical instability.

Silver, on the other hand, has a wide range of industrial uses such as in electronics, medical devices and solar panels. Therefore, the demand for silver may be affected by changes in economic conditions and technological advances. As a result, these changes in supply and demand for gold and silver can have a significant impact on the GSR.

Another important factor affecting GSR is inflation. In order to protect portfolios, investors often turn to precious metals like gold as a hedge against inflation. But changes in the currency greatly affect the prices of this precious metal. When inflation is high, the value of the currency tends to decline. And when inflation is low, the value of the currency increases, and the price of gold decreases.

A good example of this was back in 2022 when inflation soared all over the world. Since the US dollar was stronger than all the other world currencies back then, gold prices in USD were low. But as concerns about recession and inflation persisted around the last quarter of the year, the price of gold increased. Of course there are other factors which include globalists who wish to suppress the prices of gold and silver and again use ETFs (paper gold and silver markets) to manipulate the prices of physical gold and silver!

Gold Silver Ratio & Supply and Demand Price Pressure

Another factor relating to supply and demand that affects the relative prices of gold and silver often less discussed in financial circles is consideration of where the GSR is at the timing of instability in the financial system. For example, currently in 2023 as more banks are failing and even more banks are likely insolvent but still chugging along like there’s nothing wrong, investors are clearly turning to gold and silver as a hedge on their investment portfolios.

As these investments flow to gold and silver it is far easier for gold miners to increase their production because gold tends to be a primary mining metal and quite lucrative to extract and refine. On the other hand, silver tends to be a secondary precious metal which is often associated with mining of base metals such as copper and other metals. This makes it more difficult to increase production. If the GSR is low (it’s relatively low now in Spring 2023) at a time like this the pressure on the supply of silver can make it more of a scarce commodity and push the premiums up while delaying delivery of silver and this can affect the price of the commodity.

This pricing pressure can push up the price of silver and thereby suppress the GSR because in these times small increment silver coins can become hard to get all the while gold coin inventory and pricing has not been affected.

Gold Silver Ratio: Political & Economic Events

Political and economic events can also have an impact on the GSR. Changes in government policies or international trade agreements can affect the demand for precious metals, as well as the value of currencies. Other global events, natural disasters, and wars might also lead to an increase in the demand for gold and silver, which in turn may cause the GSR to increase. For example, due to the economic slowdown and financial crisis during the COVID-19 pandemic in 2020, investors were looking to put money into a more stable asset such as gold. This resulted in an increased demand for gold, which in turn increased its value by over 40%. The GSR ratio ultimately hit a record high of nearly 125:1 with gold pricing at $1,636.47 per ounce.

This demand side influence can also be the result of central banks purchasing large amounts of gold for reserves such as what has been happening in our current economic turmoil. These pressures seem to put more demand side pressure on the price of gold since central banks are focused mainly on gold and not silver.

And lastly, market sentiment and investor behavior can also influence the GSR. When investors are bullish on the economy, they may invest more heavily in riskier assets like stocks which can lead to a decline in the demand for precious metals. Conversely, when investors are bearish on the economy or concerned about global events, they may turn to safe-haven assets like gold and silver, which can then drive up the demand for these metals and affect the GSR. These are called “Risk On” and “Risk Off” investments.

“Risk on” scenarios occurs when investors put their money in riskier assets. And “risk off” refers to scenarios where investors become more cautious, leading them to invest in less risky assets such as gold or silver and other physical commodities. It is then during these risk off moments that the GSR can significantly shift, where it would increase if investors favor gold more or decrease if they invest more in silver.

The Potential Benefits of Precious Metals Investing Using The Gold-to-Silver Ratio

There are a number of potential benefits that come with precious metals investing. Firstly, precious metals can offer diversification benefits as they are not strongly correlated with other asset classes such as stocks and bonds although they tend to be inversely correlated with equity holdings. So by investing in gold and silver, you can further diversify your investment portfolio.

Gold and silver investing can also help protect you from the effects of inflation on your portfolio. This is because the value of precious metals tends to increase when the purchasing power of fiat currencies declines. In truth, the “value” of the metals stays the same but the amount of “currency” that it costs to purchase it is what changes!

Lastly, precious metals have been used as a store of value for hundreds of years. By silver and gold investing, you can benefit from the historical durability and stability of these assets even in times of economic uncertainty. And with the help of the gold-to-silver ratio, you can then identify when to put more of your investment budget into gold and when to put it into silver instead, or even what ratio into each if your goal is to acquire both. After all, gold takes up less space but many agree that there is currently a higher upside potential for silver. However silver is a lot heavier and takes up a lot more space than gold!

Strategies for Investors Utilizing The Gold-to-Silver Ratio

One of the common gold-to-silver ratio strategies is by using it as a timing tool for buying and selling precious metals. When the ratio is high, it suggests that gold is overvalued relative to silver, which may indicate a good time to sell gold and buy silver. Conversely, when the ratio is low, it means that silver is overvalued relative to gold, which may indicate that it’s a good time to sell silver and buy gold.

For example, at the time of this writing in early-May 2023, we are currently experiencing a relatively high ratio of 79:1. Which means that you need about 79 ounces of silver to purchase one ounce of gold. And when gold’s current price was at $2,031.66, and with silver at a relative bargain with a spot price of $25.77, it might be the right time to sell some gold and buy some silver with a profit. However, do your due diligence before making any investment decisions. After all, you may have a different cost basis than someone else therefore this may or may not apply well to your situation. There is also the factor of the spread or premium that most dealers charge which makes selling questionable unless the cost basis was much lower than the current price!

The gold-to-silver ratio can also be used as a way to re-balance your portfolios. If the ratio moves significantly in one direction, it could mean that your portfolio is also out of balance and that you may need to adjust your holdings accordingly. The easiest way to apply this may be in terms of making decisions on which one to purchase more of at any given time.

Risks and Rewards of Investing in Precious Metals: How to Manage Risk with the Gold-to-Silver Ratio

As previously stated, precious metals are often considered safe-haven assets that can protect investors from inflation, currency devaluation, and geopolitical uncertainty. However, as with any investment decision, they are not without risks.

Understanding the potential risks is key to effectively managing your investments using the gold-to-silver ratio. And as an investor, you should always take into account your own personal financial situation before taking on additional risk with any form of trading.

Moreover, by maintaining an understanding of the factors affecting the gold-to-silver ratio, as well as researching historical trends and patterns, you can better manage the risks while still reaping the rewards that come from investing in precious metals.

A Final Note on Investing with the Gold-to-Silver Ratio

When investing with the gold-to-silver ratio, it is important to be aware that there are a number of factors that affect this ratio and that historical analysis can offer insight into trends and patterns. Therefore, as a savvy investor, you must familiarize yourself with these factors before making any decisions regarding your investment portfolio or strategy when it comes to the gold-to-silver ratio.

Being mindful of how the effects of these external influences change over time can provide indications as to when you should enter or exit the market and increase or decrease your holdings of any particular asset. With this knowledge, you can then decide the best timing and of what types of investments are best suited to maximizing your profits while limiting risks.

So if you are looking for results in precious metals investing, an understanding of the Gold-to-Silver Ratios’ inner workings is essential. And as you learn how to implement the GSR into your investment strategy a self-directed Gold and Silver IRA can be a great vehicle to gather your investments and minimize tax liability. Click here to get a Free Precious Metals IRA kit from one of the top-rated providers of this type of service with an A++ and five-star rating.

Affiliate Disclaimer:

We review products independently with as much accuracy as possible, but we may earn affiliate commissions if you click a link and purchase a product.

Here’s some recent financial related videos from our bitchute channel:

RIGGED [AGAINST YOU]- Project Icebreaker

You can see all these videos right when we post them and subscribe on our bitchute channel here:

https://www.bitchute.com/channel/knowingthetruth

Independent precious metals investor since 2006 who has learned through mistakes he hopes to help you avoid. Self employed entrepreneur since birth 😉 Owner of www.HealthHarmonic.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/tny_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/tny_ag_en_usoz_2.gif)