Regal Assets vs Noble Gold Comparisons for 2022

Regal Assets vs Noble Gold Comparisons for 2022

Regal Assets and Noble Gold are two major players in the precious metals industry in 2022. The companies have different histories, but they overlap in terms of products and services in many different ways. In this guide, we will examine each company’s products, services, and reputation to help determine which is right for you.

Quick Summary

| Regal Assets | Noble Gold | |

| Types of Precious Metals Offered for IRA | Gold, Silver, Platinum, Palladium | Gold, Silver, Platinum, Palladium |

| Accepted Depositories | Brinks Depository in Utah or any other depository in the United States | Depositories in Texas and Delaware |

| IRA Account Minimum | $10,000 | $2,000 |

| Setup Fee | FREE | FREE |

| Annual Fee | $125 per year | $80 |

| Custodian/Storage Fee | $90 per year | $150 to $225 per year |

| Better Business Bureau Rating | C+ | A+ |

| Best For | Investors who wish to add more than $10,000 in savings to a precious metals IRA and also store their precious metals at their preferred depository | Investors with limited savings who wish to set up a precious metals IRA and want to store their precious metals at depositories in Texas or Delaware |

What is Regal Assets?

Regal Assets is a California-based IRA firm founded in 2009. The company offers precious metal investments and precious metal IRAs. Regal Assets also notably offers cryptocurrency IRAs and bundles containing both precious metals and cryptocurrency.

Some of the key things Regal Assets offers include:

- Precious metals and cryptocurrency IRAs

- Precious metal and cryptocurrency bundles

- A precious metals buyback program

- A partnership with Brinks Depository in Salt Lake City, Utah

What is Noble Gold?

Noble Gold is a precious metals IRA founded by Collin Plume in 2017. Plume was a former Regal Assets IRA advisor. Despite being a new face in the precious metals industry, Noble Gold has developed an excellent reputation thanks to its stellar customer service quality.

Some notable services and features Noble Gold offers include:

- Precious metals IRAs

- Collector’s coins (numismatics) as non-IRA investments

- Precious metal bundles as non-IRA investments

- An easy online sign-up process

- A low minimum investment amount

Regal Assets Products and Services

Regal Assets main products and services include:

- Precious metal investments

- Precious metal buyback program

- Precious metal and crypto packages

Precious Metal Investments

Regal Assets offers gold, silver, platinum, and palladium investments that can be added to your precious metals IRA. The company lets you set up a brand-new precious metals IRA if you don’t already have an existing one. Alternatively, you can rollover your existing IRA with the company. Some of the plans that can be rolled over include 401(k), 403(b)s, Thrift Savings Plans, and Simplified Employee Pensions.

The precious metals you purchase for your precious metals IRA can be stored at any depository in the country. However, Regal Assets has partnered with a Utah-based depository called Brinks and encourages clients to store their precious metals there.

Precious Metals Buyback Program

Regal Assets offers an excellent buyback program designed to give clients the full value of their precious metals quickly when they decide to sell them. The company cannot legally guarantee the buyback of precious metals. However, their website states they have never refused an opportunity to buy back precious metals from the clients who purchased them from the company.

Regal Assets quotes the highest buyback price for the precious metal based on the trading price from the day the client has chosen to sell. The company doesn’t charge liquidation fees for precious metals, which encourages clients to liquidate their assets whenever they need to.

Precious Metal Packages

Regal Assets offers six packages containing precious metals and cryptocurrency. The precious metals in these packages are non-IRA investments, so they won’t be added to your IRA. However, they can still be a great way to convert some of your wealth into precious metals

Note: These package purchases fall under Regal Assets’ non-IRA transactions and aren’t subject to the company’s IRA account minimum requirements.

The various packages and their corresponding values are listed below:

- Merchant Package: $5,000

- Knighthood Package: $10,000

- Legacy Portfolio: $25,000

- Kingship Portfolio: $50,000

- Dynasty Portfolio: $100,000

- Coronation Portfolio: $250,000

Each of the above packages contains precious metal coins and bullions. The company website does not disclose the contents of each package and only states that they contain both precious metals and cryptocurrency.

Regal Assets Disbursements

Regal Assets has not offered any information about IRA disbursements on its website. You will need to contact the company directly and speak with one of its representatives to get information on disbursements, but these are standard practice in the industry and typically offered as either “in-kind” (precious metals) or liquidated to cash disbursements. These are legally allowed by the IRS for retirement age beneficiaries of an IRA.

Noble Gold Products and Services

- Gold IRA

- Silver IRA

- Buyback Program

- Collector’s coins (numismatics)

- Royal Survival Packs

Gold IRA

Noble Gold purchases and sells gold coins and bullions. Once you are a client with Noble Gold you can add your purchase to a Gold IRA account they can setup for you. Alternatively, you can rollover your existing retirement account into a self-directed Gold IRA and then add gold to it. Gold coins and bullions purchased from Noble Gold can be stored at depositories in Texas or Delaware.

Silver IRA

Noble Gold’s Silver IRA is identical to its Gold IRA, but with the option of purchasing silver coins and bullions The company has advertised the various silver coins and bullions you can purchase on its website. These silver coins and bullions will also be stored at a depository in Delaware or Texas and this type of precious metals IRA may offer more upside potential due to a global shortage of physical silver and this cycle of historical ratios of gold to silver price ratio.

Buyback Program

Noble Gold’s buyback program offers a fast way to sell your precious metals.

Noble Gold offers a “no-qualms buyback program” that allows you to sell back the precious metals you purchased from the company with no questions asked. The company hasn’t disclosed much information about this buyback program so we cannot compare it with Regal Assets’ buyback program but their reputation is solid so we presume their buyback program is also solid.

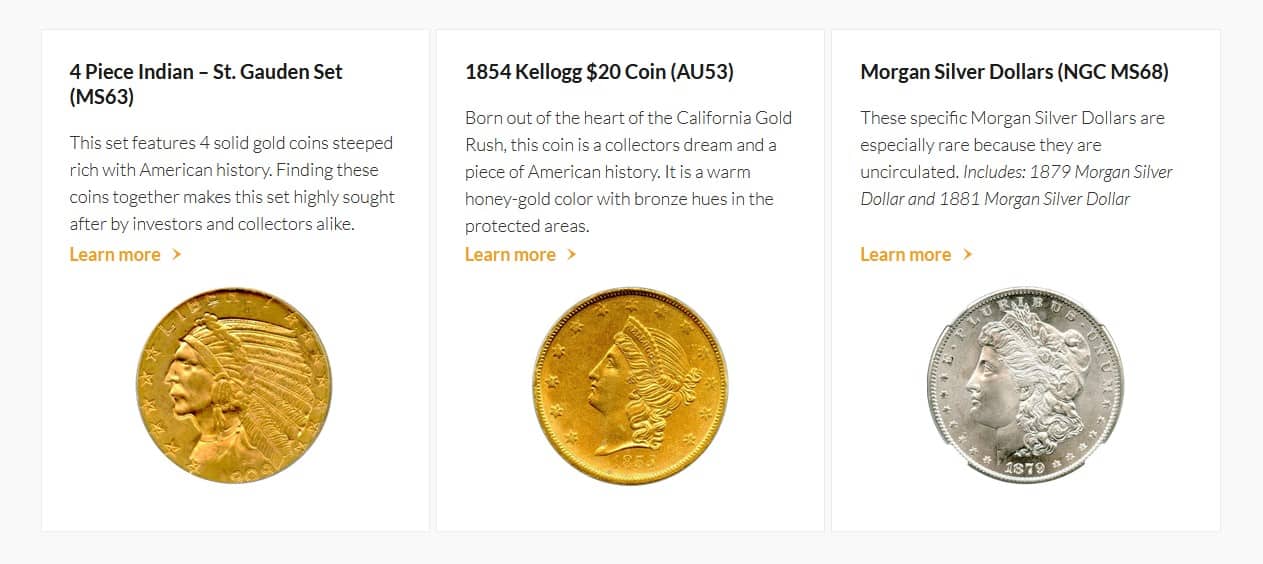

Collector’s coins

Noble Gold stands out for offering collector’s coins made from gold and silver. These coins cannot be added to your precious metals IRA. However, they may serve as great investments for people seeking something rare and with the ability to greatly appreciate in value.

The value of these coins comes from the gold and silver they are made from as well as their rarity. Many coin collectors will pay high prices for these coins, which makes them unique investments however as you may already know from our other reviews here on InvestInGoldCoins.net we personally prefer the simpler investment in precious metal bullion that is not reliant on collectors to assess their value.

Royal Survival Packs

Noble Gold offers precious metals bundles similar to what Regal Assets provides. The precious metals in these bundles aren’t added to your precious metals IRA, but they can serve as an excellent way to convert some of your savings to precious metals. The Royal Survival packs range from $10,000 to $500,000 in value.

- Noble Knight: $10,000

- Noble Baron: $25,000

- Noble Viscount: $50,000

- Noble Earl: $100,000

- Noble Marquess: $250,000

- Noble Duke: $500,000

Product Comparison: Gold and Silver IRAs

Regal Assets and Noble Gold’s Gold and Silver IRAs can seem similar at first glance. After all, both companies offer a variety of gold and silver coins and bullions for customers to purchase. These precious metals can also be added to your precious metals IRA account easily once you have set up an account with the company.

Clients can also rollover their existing retirement accounts to these IRA companies with relative ease. However, it should be noted that retirement pensions are not eligible for IRA rollovers under Noble Gold. Other companies such as Regal Assets do allow retirement pension rollovers, which means Noble Gold is lacking in this area.

Product Comparison: Collector’s Coins

Noble Gold offers collector’s coins (numismatics) as non-IRA precious metals investments while Regal Assets does not. Clients can still purchase ordinary coins and bullions from Regal Assets. While these ordinary coins and bullions may not enjoy the potential value appreciation that collector’s coins offer they are a much more straight forward investment which doesn’t rely on a collector to determine their value in the future.

Some precious metals investors may consider investing in these numismatic coins as an added hedge against inflation and market uncertainty since their value isn’t dependent on just precious metal prices but I personally am not one of those investors!

Services Comparison: Depositories

Under IRS regulations, precious metals for precious metals IRAs must be stored in approved depositories. Precious metals IRA companies typically differ in the depositories they work with. The different depository options available for clients at Noble Gold and Regal Assets are described below.

Noble Gold Depositories

Noble Gold is special because they are partnered with International Depository Services (IDS). This partnership means Noble Gold clients have the option of storing their precious metals in their precious metals IRA in either Texas or Delaware. These options can seem good, but they are relatively limited compared to what Regal Assets offers in regard to depositories.

Regal Assets Depositories

As mentioned earlier, Regal Assets has partnered with a depository called Brinks in Salt Lake City, Utah. The company makes it easy to acquire precious metals in your precious metals IRA and store them at Brinks depository thanks to this partnership. However, clients can also store the precious metals from their precious metals IRA at any other depository of their choosing inside the United States. This option is great for people who would like to leave their alternative assets from their IRA at a depository close to their home state.

So when comparing Noble Gold and Regal Assets in terms of freedom to choose depositories, Regal Assets comes out on top but how significant is this really?

Product Comparisons: Precious Metals Packs

Both Regal Assets and Noble Gold offer precious metals bundles for people who want to invest in precious metals quickly and independently from their precious metals IRA.

Regal Assets’ bundles cost between $5,000 to $250,000, while Noble Gold’s Assets cost between $10,000 and $500,000. It’s difficult to say whether a bundle from one company is better than a bundle from another company. However, we can see that Regal Asset’s cheapest bundle is more affordable than Noble Gold’s cheapest bundle. This implies that Regal Assets’ bundles are accessible to people who wish to convert a relatively small amount of savings into precious metals. However, as you’ll see below this may not be a significant factor in making your decision.

On the opposite end of things, at $500,000, Noble Gold’s priciest bundle costs far more than Regal Assets’ priciest bundle, which tops out at only $250,000. This means investors interested in converting $500,000 in savings into various precious metals can do so by signing up with Noble Gold.

Services Comparison: Account Minimums

The minimum investment amount for a precious metals IRA with Regal Assets is $10,000 while Noble Gold’s precious metals IRA minimum investment amount is only $2,000. This is a huge difference and impacts who can afford to set up a precious metals IRA with the company.

People who are unsure about investing lots of money in a precious metals IRA will find it easier to sign up with Noble Gold compared to Regal Assets due to their lower account minimums.

Please note that these IRA account minimums are independent from the precious metal bundles, which fall under non-IRA purchases. This is why Regal Assets can offer their Merchant Package with a value of $5,000, despite their IRA account minimum being $10,000.

Services Comparison: Fees

Precious metals IRA typically charge their clients different fees such as a setup fee and annual fees. The setup fee generally covers the cost of setting up the precious metals IRA or rolling over an existing retirement account to a precious metals IRA. The annual fee covers many things such as the cost of getting advice from the company’s advisor, precious metals storage, and custodian fees. However, some precious metals IRAs charge custodian fees separately.

| Regal Assets | Noble Gold | |

| Setup Fee | FREE | FREE |

| Annual Fee | $125 per year | $80 |

| Custodian/Storage Fee | $90 per year | $150 to $225 per year* |

*Noble Gold’s storage Fee varies based on the type of precious metals held and the depository the client has chosen.

As you can see, you will pay a total of $215 per year when you sign up with Regal Assets and between $230 and $305 per year when you sign up with Noble Gold. This makes Regal Assets a less costly choice if you are concerned about paying high fees to maintain your precious metals IRA but you’ll see some other more important factors in our conclusion if you keep reading.

Service Comparison: Ease of Account Setup

Both Regal Assets and Noble Gold make the Gold IRA account setup process quick and easy for people who might be intimidated by the idea of setting up an alternative assets IRA account.

Setup Process at Regal Assets

The IRA account setup process at Regal Assets is as follows:

- Visit Regal Assets’ website

- Fill out an account setup form

- Work with a company specialist to complete the setup process

- Starting funding the account with your desired precious metals

The account setup process described above can be completed in under 24 hours.

Setup Process and Noble Gold

The IRA account setup process at Noble Gold is as follows:

- Visit the Noble Gold website

- Go to the “Open an Account” section

- Fill out your personal information, investment account information, details about your precious metal’s custodian, your desired account type, and your rollover amount

- Wait for a call from the Noble Gold specialist who will confirm your new account

It’s difficult to say whether the setup process at one of the above companies is better than the other since both companies make the process fast and easy. Therefore it is safe to say both companies offer an efficient and hassle-free setup process but there’s more to that story…

Service Comparison: Education Resources

Both Regal Assets and Noble Gold offer education resources for clients. Let’s compare both sets of resources.

Regal Assets Education Resources

Regal Assets offers a FREE Gold Kit guide that discusses the various benefits of precious metal IRAs such as:

- Protecting your savings from inflation

- Setting up a hedge against uncertainty in stock markets

- Saving on taxes

Regal Assets provides a free Gold Scams report. This guide covers topics such as:

- Popular gold scams to look out for in 2022

- Comparing physical and “paper” gold

- How to a find gold dealer you can trust

- Choosing the best depository for your gold

- Information on “home storage” gold IRAs (this seems to contradict IRS law!)

Noble Gold’s Education Resources

Noble Gold offers a Gold & Silver Guide that teaches investors:

- What is a Gold and Silver IRA?

- What is the procedure to own gold and other precious metals

- The advantages of setting up a Gold and Silver IRA

- How to purchase gold with a 401k or IRA

The company also offers a guide called Precious Metals 101 that covers the following topics:

- When to buy gold

- Why invest in gold

- How to invest in gold

Noble Gold’s Investment Basics guide includes resources such as:

- Types of retirement accounts

- Tips during an economic crisis

- Inflation vs. Gold

As you can see, both companies offer ample resources to educate you about different things. Noble Gold’s resources are better if you’re looking for tips on how to invest and choose a retirement account. Regal Assets’ education resources are helpful if you’re looking for information on avoiding gold scams, choosing a suitable gold dealer, and finding a safe depository for your gold.

It should be noted that both companies have advisors and specialists who can educate you in different areas. Therefore, you can gain the same knowledge from both companies if you’re willing to contact their specialists directly.

Service Comparison: Customer Service Quality

Regal Assets has been around much longer than Noble Gold, so the company has dealt with more complaints than Noble Gold has. This resulted in a wide gap in the perceived customer service quality between companies. Each company’s customer service quality is detailed below.

Regal Assets Customer Service Quality

Regal Assets has an average track record when it comes to customer service. The company presently has a C+ rating with the Better Business Bureau (BBB). This non-profit organization keeps track of company complaints launched by customers in the United States. It awards a rating to these companies based on how quickly and how well they have handled the complaint. A “C+” rating typically implies the company is slightly below average in handling customer complaints.

Having read some of these complaints on the BBB website I have strong reservations about relying on Regal Assets until they catch up and get their issues resolved.

Regal Assets also enjoys a 4.9/5 rating on BirdEye. This is an average score taken from 1700 reviews on the independent review website.

Noble Gold Customer Service Quality

Noble Gold has an A+ rating from the Better Business Bureau (BBB). This is a very good rating and implies Noble Gold’s customer service is top notch. Noble Gold also enjoys a perfect 5/5 rating on the ConsumerAffairs website based on 163 ratings.

Based on the above information, we can conclude that Noble Gold offers better customer service quality than Regal Assets.

Final Verdict

As you can see, both Regal Assets and Noble Gold offer similar products and services for clients. The companies do differ in terms of fees, bundles, accepted depositories, customer service quality, and rare collector’s coins products.

Regal Assets edges out Noble Gold in the depositories category because they allow you to store the precious metals in your precious metals IRA at any depository in the United States however given all the unresolved complaints that are pending on BBB that relate to delivery of precious metals to these depositories this seems like a moot point. If your gold doesn’t arrive at the depository then having more choices on which depository you can use sure doesn’t seem to matter.

Noble Gold is unique because they offer collector coins that give you an opportunity to invest in a unique precious metals asset that isn’t tied to your precious metals IRA and they also have a solid reputation for delivering both these as well as the bullion they offer as represented by their A+ rating on BBB.

Noble Gold charges lower fees than Regal Assets. Their account minimums are also much lower, which makes setting up a precious metals IRA more accessible for people with less savings. Noble Gold also has a much better reputation for delivery as I’ve explained and they clearly are handling customer complaints much better. Based on this information, we can conclude that Noble Gold is better than Regal Assets in most areas and I recommend Noble Gold as a noble choice for your precious metals investing.

Learn more about Noble Gold by visiting their website and requesting your free information kit.

Independent precious metals investor since 2006 who has learned through mistakes he hopes to help you avoid. Self employed entrepreneur since birth 😉 Owner of www.HealthHarmonic.com