De-Dolarization: When Will US Dollar Dominance Fail?

De-dolarization is a term being used to describe the departure from the hegemony of the US Petrodollar standard, or US dollar dominance in global trade in macro-economic models.

De-dolarization is not a new concept but the understanding of it has become more important in light of recent geopolitical changes including economic sanctions which ironically serve to degrade dollar dominance.

After our recent report on Dedolarization a number of questions have come in so in this post we will explore some of the recent history of the last couple decades that got us here as well as recent developments so you can better understand what to expect especially in terms of where this will likely push the “value” of gold and silver which for Americans is typically thought of in US dollar terms.

After all, at the end of the day what you want is to preserve the wealth that you’ve saved from decades of work. If it’s currently held in US dollar denominated assets de-dolarization is an important concept so you can maintain your wealth regardless of which currency or asset becomes the world’s standard trading asset to displace US dollar dominance that has held for so long.

And what’s driving this trend away from the US Dollar?

Well clearly it’s a rogue administration that’s currently inhabiting the white house but let’s go deeper than that shall we?

Learn More About The Security of a Precious Metals IRA

At the center of this is the largest oil producing nation on the planet, Saudi Arabia. The Saudi’s have been in the oil news lately as they solidify their ties to China and move away from the long standing ties they’ve had with the US.

Simon Watkins from OilPrice.com puts it this way:

And yet, the U.S. is surprised by the apparent finalisation of the transition of Saudi Arabia away from Washington and towards China, which effectively marks the end of the 1945 core agreement between the U.S. and Saudi Arabia that defined their relationship up until extremely recently. This transition has been seen most recently in the refusal of MbS to take a telephone call from President Joe Biden in which he was to ask for his help in bringing down economy-crimping high energy prices and then in the huge cut in collective OPEC oil production that has only added to energy-driven inflationary fears for global economies.

This is of course as China has been pouring money into Saudi infrastructure in order to help them increase their production of crude oil. Their goal is to reach 13 million barrels per day and China is not cowering in climate change rhetoric but instead knows they want it.

Watkins summarizes the point with regards to de-dolarization quite well:

Given the transition of Saudi Arabia away from the U.S. and towards China – and the senior Saudis do look at the issue in these terms, whatever they say publicly – there is also every reason to expect Riyadh to continue to back China’s efforts to undermine the power of the U.S. dollar in the global energy markets as well. Not only is Saudi Arabia now a prime mover in advancing the China-GCC Free Trade Agreement (FTA) – a key aim of which is to forge a “deeper strategic cooperation in a region where U.S. dominance is showing signs of retreat” – but also the Kingdom is now a prime advocate for switching away from the hegemony of U.S. dollars in the pricing of global oil and gas.

When we combine that with a giant hedge-fund leader warning investors that the world is…

“on the path to hyperinflation,” which could lead to “global societal collapse and civil or international strife.”

as reported by MSN.com

That was from Elliott Management Corporation which seems to be giving it’s investors a dose of truth lately.

Learn Why NOW Is The Time To Invest in a Gold IRA

You may have heard of the BRICS nations (Brazil, Russia, India, China and South Africa with other nations joining) setting up an alternative to the SWIFT international wire transfer system in order to bypass the US dollar as the primary trading asset.

Before we dive into more history of international trade that is deviating from the established petrodollar hegemony based on the above mentioned core agreement of 1945, let’s additionally consider the current status of the eCNY which is China’s CBDC (central bank digital currency).

In terms of global geopolitics the overarching concern that most countries seem to have is regarding the fiscal irresponsibility in the US reaction to Covid-19 and the massive inflation of the money supply that followed.

Other countries who were already in a heated battle for dominance as a global reserve currency for oil trade seem to have been pushed to move faster.

From Blockworks.co

“The e-CNY has the potential to be used for cross-border transfers and payments if other countries buy in as well,” said National University of Singapore’s Ruan. “It remains to be seen whether the e-CNY could challenge the dominance of the US dollar in that domain.”

China’s official position is that it has no desire to replace the USD. On a recent panel, PBoC governor Li Bo has said that the efforts are primarily for domestic, not international use.

“For the internationalization of the renminbi, we have said many times that it’s a natural process, and our goal is not to replace the US dollar or other international currencies,” Li said while speaking at the Boao forum. “I think our goal is to allow the market to choose, to facilitate international trade and investment.”

The interesting thing that I note about these quotes and statements is what I’ve heard is that the technology behind the eCNY (and not the eCNY itself!) which has been thoroughly tested at this point, is being used as a template to create a new system for the BRICS nations to use to replace the US dollar reserve currency for the international trade of natural resources. If true this would of course make Li’s statements truthful but deceptive.

With this in mind it’s interesting to hear about other “cross border CBDC” testing that’s ongoing after testing of the eCNY system with transactions between Hong Kong and mainland China and this was from December 2021:

Yesterday Mu Changchun, who heads the Digital Currency Research Institute at the People’s Bank of China (PBoC), said the digital yuan trials between Hong Kong and China have moved into a second phase. This links the Chinese central bank digital currency (CBDC) wallets to Hong Kong’s Faster Payments System (FPS). Mr. Mu was talking at a joint seminar between the PBoC and the Hong Kong Monetary Authority (HKMA).

Recapping on the first phase of the tests, these enabled Chinese visitors to Hong Kong to recharge, transfer and spend money using their digital RMB (eCNY) wallets. Trials involved local Hong Kong banks and a limited set of Hong Kong merchants. In China there were also tests enabling Hong Kong visitors to the Luohu District of Shenzhen to use the digital yuan.

Also mentioned in the above ledgerinsights.com post are ongoing cross border CBDC tests between Singapore, Malaysia, Australia, and South Africa as well as between France and Switzerland.

Claim Your FREE Report to Find Out Why NOW is the Best Time to Buy Gold

We will write more on this as more information and references come up and when more is disclosed about Saudi Arabia becoming an official member of the BRICS coalition.

Another piece of the puzzle is the SCO (Shanghai Cooperation Organization) which is a growing group of countries that have formed alliances for local currency swaps to facilitate international trade, again as an alternative to the SWIFT system and bypassing US dollar denomination.

These organizations of countries have been growing for many years. SCO was started in 2002 with 6 countries (China, Russia, Kazakhstan, Uzbekistan, Kyrgyzstan, and Tajikistan) and since then membership has been expanded with India, Pakistan joining in 2017 and the newest member is Iran who joined in 2022. Many other counties are on observing status and may be engaged in trade in the near future.

From ForeignPolicy.com :

This agenda is in line with individual policies on the part of the group’s most prominent members, including Russia’s attempt to cushion the blow of Western sanctions, China’s deteriorating relations with the United States, India’s use of nondollar currencies in its trade with Russia, and Iran’s recent proposal for a single SCO currency. Chinese President Xi Jinping proposed to address development deficits through regional integration, especially by expanding the shares of local currency settlements, strengthening the development of local-currency cross-border payment and settlement systems, and promoting the establishment of an SCO Development Bank.

So as you can see at this point there is no central bank operating the SCO trade agreements but the group is growing.

With the financial sanctions imposed on Russia and the Putin blaming the UK Royal Navy for the attack on Nord Stream pipeline it seems arguable that Russia has a financial need to secure alternative markets for it’s natural resources in addition to alternative payment methods that don’t involve sanctioned western currencies.

Learn More About The Security of a Precious Metals IRA

From ForeignPolicy.com :

A closer alignment between BRICS and the SCO toward de-dollarization is already taking place. Then-SCO Secretary-General Vladimir Norov confirmed last year that the SCO members have been working on a gradual transition to using local currencies for settlements. He also suggested the SCO establish partnerships with the Asian Infrastructure Investment Bank, the New Development Bank, and the Silk Road Fund to fully unlock the investment potential of the SCO.

I personally have a hard time not concluding that this is an intentional push to drive conflict in the financial systems creating a divide between a western, US dollar denominated system and an eastern non-dollar denominated system. Combine this with Russia pegging the ruble to gold at 5000 rubles per gram of gold and forcing international trade in ruble you can bet this stimulated their economy.

From Forbes in May of 2022:

U.S. companies that have either international suppliers or customers could be jolted by Russia’s golden move. Overseas business partners may need to barter gold for rubles to pay for inputs, like energy, minerals or fertilizers, and therefore demand that their U.S. counterparts pay in rubles or bullion. Additionally, American firms may need to acquire a stack of rubles to pay for their own inputs for foreign-based factories, warehouses or raw materials.

With all this in mind why does it appear that the trading value of gold has been on the decline for US investors?

It’s an interesting question but consider these factors: Fiat currencies such as the US dollar are “valued” in relative terms in trade with other fiat currencies. Couple that with the serious troubles hitting Europe and the Euro value right now. After all some of these countries in western Europe literally may not have fuel to heat their homes this winter!

With all that in mind it makes sense that the relative strength of the US dollar should be temporarily strong, at least for the moment…

Learn Why NOW Is The Time To Invest in a Gold IRA

After all there are serious issues facing Germany alone, and they are considered the strongest of the Eurozone markets. BASF, the massive chemical and raw materials conglomerate that was one of the Nazi companies broken up after WWII, has already partially shut down it’s massive chemical manufacturing campus because they can’t get enough fuel to run it. A result of Russian economic sanctions and the sabotage of the Nord Stream pipeline, BASF is moving to China.

We can expect the Euro to continue to crash along with the Japanese Yen with respect to the US dollar giving US investors a temporary discount on previous metals.

Is this effort to squeeze out the US dollar dominance simply being sped up by the Russia/Ukraine war?

From GlobalTimes.cn

Russia’s highly daring and innovative move to stabilize its own currency in time of difficulty has greatly incentivized other governments to follow suit. Now, there are media reports saying the BRICS countries are seeking to discuss deepening trade in their own currencies. For example, the R5 initiative has been proposed, targeting the use of the respective national currencies of BRICS – ruble (Russia), rupee (India), rand (South Africa), real (Brazil) and renminbi (China), to help settle trade among themselves.

Therefore, the unprecedented Western sanctions imposed on Russia, including restrictions on its central bank, now increasingly threaten to dilute the dominance of the US dollar and may result in a more fragmented international monetary system. To date, Moscow has almost entirely sold off its American bonds, and lately, there are growing signs that the world’s other major economies begin to dump US Treasuries and other dollar-denominated American assets.

The significance of Moscow’s de-dollarization drive is that it is the most radical of de-dollarization measures taken by a sovereign nation. Russia has not only implemented de-dollarization measures domestically, but is also taking some tough measures in testing its own financial information exchange system.

Is this current situation giving US investors like yourself a brief opportunity to hedge your accumulated wealth by investing in precious metals now while the US dollar is strong relative to other western currencies?

Personally I wouldn’t take this relative “discount” for granted. After all there is a continued international push towards de-dolarization.

No one knows exactly when the US dollar hegemony will finally break. We do know that when it does that all the countries that have been forced for decades to hold petrodollars in reserve for crude oil trade will no longer need these. When this happens, and it seems inevitable and more of a question of when not if, these countries will be forced to dump their US dollar reserves on the international market.

Claim Your FREE Report to Find Out Why NOW is the Best Time to Buy Gold

When the shift happens, and it sure seems it could happen soon, this is likely not just going to affect US investors but the entire economy would likely have a shake up like none of us has seen in our lifetimes!

Hedge-funds run by billionaires are warning investors with words like this:

“investors should not assume they have ‘seen everything’ ”

What we are seeing right now is only the beginning, but is it the beginning of the end for the US dollar?

The only question in my mind is whether this is all a planned attack on the US dollar.

Whether intentional or not it is likely to cause a triggered massive decline in the US dollar value and buying power for hard assets such as gold and silver.

Wealth Preservation | Diversify Your Portfolio

These developments are yet another indication of the volatility that surrounds us, not only in the financial markets but globally as well. If you have assets that you want to protect, and you’re worried about the direction the economy is taking, shouldn’t you take steps to start defending your wealth? Click here to learn how diversifying your retirement assets can help.

Risk Disclosure: All investments including precious metals, such as gold and silver, involve risk and you may get less back than what you put in. Always consult a licensed professional financial advisor before investing your money. Consumers should be aware that past performance does not guarantee future returns.

Disclaimer: The owners of this website may be compensated for recommending certain companies, products, and services. While we endeavor to make sure all our content is accurate, the information we provide may not be neutral or independent and does not constitute financial advice.

References:

OilPrice.com

https://oilprice.com/Energy/Energy-General/Saudi-Arabia-Reiterates-Commitment-To-China-Regardless-Of-US-Concerns.html

MSN.com

https://www.msn.com/en-us/money/markets/hedge-fund-giant-elliott-warns-looming-hyperinflation-could-lead-to-global-societal-collapse/ar-AA13GPFd

Blockworks.co

https://blockworks.co/analysis-what-exactly-is-chinas-cbdc/

LedgerInsights.com

https://www.ledgerinsights.com/why-microsoft-led-palm-nfts-27m-funding-round/

ForeignPolicy.com

https://foreignpolicy.com/2022/09/21/china-yuan-us-dollar-sco-currency/

Forbes:

https://www.forbes.com/sites/zengernews/2022/05/02/russias-move-to-gold-may-jolt-your-company/?sh=719dc71d72e6

GlobalTimes.cn:

https://www.globaltimes.cn/page/202208/1272908.shtml

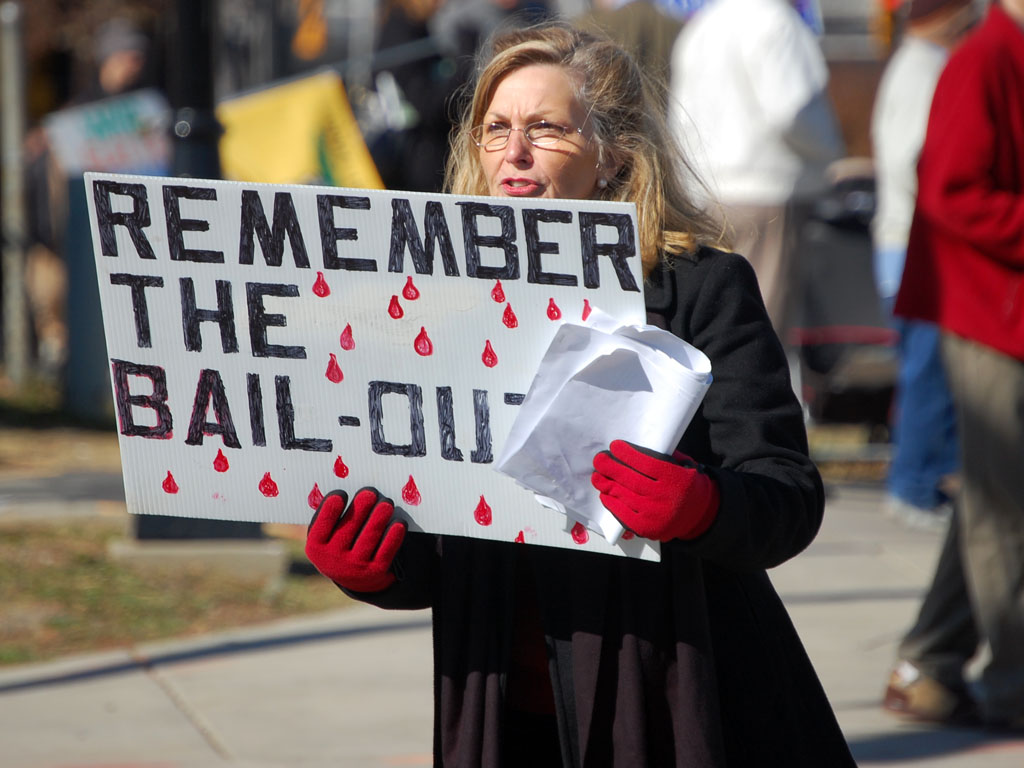

Featured Photo By James Willamor

Dollar Image courtesy of: Jo Zimny Photos

Shanghai skyline Image courtesy of: 看见灰机灰了

Independent precious metals investor since 2006 who has learned through mistakes he hopes to help you avoid. Self employed entrepreneur since birth 😉 Owner of www.HealthHarmonic.com

After Obama and Biden’s destructive care of our country…….. I’m surprised we have a standing in world affairs at all!!! I included Obama as he was the one who wanted the US to be a Socialist country. Biden is controlled, a puppet if you will. Even as a senator he was a buffoon. As for your website, I like it.